Introduction to Fashion Industry of Vietnam

Vietnam is one of the major exporters of garments and allied products and holds a significant value in world exports. The textile and apparel industry of holds significant importance in the global economy, generating approximately $905 billion in revenue in 2023. It serves as a crucial source of employment, trade, and innovation, while also driving social and environmental change.

Several key players dominate the global textile and apparel market, including China, Bangladesh, Vietnam, Turkey, and India. These countries collectively contribute to over 70% of the world’s clothing exports, each with its own unique strengths and challenges within the industry.

China stands as the undisputed leader in textile and apparel production, boasting the highest volume and value of garments and fabrics exported worldwide. However,

China faces mounting labor costs, environmental pressures, and escalating competition from other nations.

Bangladesh holds the position of the second-largest clothing exporter globally, specializing in cost-effective and high-volume production. While the country benefits from a large and inexpensive labor force, it also grapples with inadequate working conditions, safety concerns, and low productivity.

Vietnam, the third-largest clothing exporter, is akin to the Textile and Apparel ‘Water Buffalo’ exhibiting the fastest growth among the top five players. Vietnam’s strategic location, skilled and youthful workforce, and emphasis on quality and design contribute to its success. However, challenges such as limited access to raw materials, dependence on foreign markets, and the need for increased innovation and sustainability persist.

Turkey ranks as the fourth-largest clothing exporter globally and the largest in Europe. The nation boasts a robust domestic market, a diverse product range, and a high level of vertical integration. Nevertheless, Turkey faces obstacles such as political instability, currency fluctuations, and soaring energy costs.

India, the fifth-largest clothing exporter, takes pride in being the largest producer of cotton. The country benefits from a vast domestic market, a rich heritage of textile

craftsmanship, and immense potential for innovation and technology. However, India encounters hurdles such as infrastructure bottlenecks, regulatory barriers, and social and environmental concerns.

Overall, the textile and apparel industry encompasses a complex landscape of economic, social, and environmental factors, shaping its trajectory on a global scale.

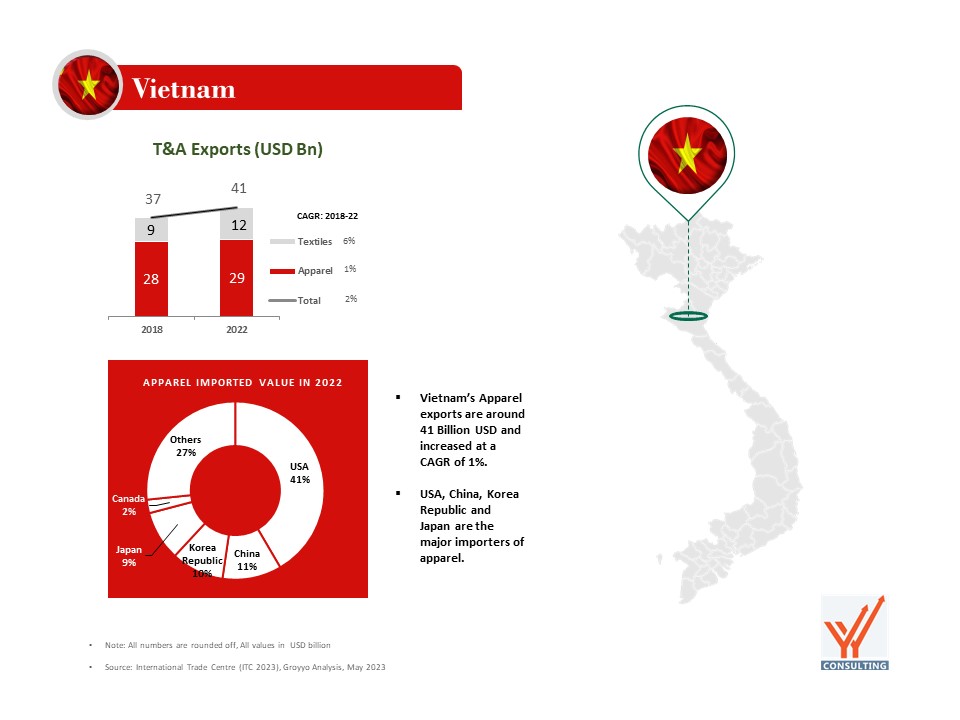

Vietnam’s textile and apparel industry has experienced remarkable growth in the past decade, becoming one of the country’s key economic sectors. The industry’s export value increased from $17.9 billion in 2013 to $43.4 billion in 2023, and strive to achieve $100 billion by 2030.

Exploring Vietnam’s Textile and Apparel Industry

Vietnam’s textile and apparel industry has witnessed remarkable growth in the past decade, emerging as a pivotal economic sector in the country. The industry’s export value surged from $17.9 billion in 2013 to a staggering $43.4 billion in 2023, and strive to achieve $100 billion by 2030. Employing approximately 2.5 million workers, predominantly women, this industry contributes around 16% to Vietnam’s GDP.

Key Highlights of Vietnam’s Textile and Apparel Sector

Vietnam’s textile and apparel industry boasts several competitive advantages that

position it as a rising star in the global market. Here are some noteworthy highlights:

1. Strategic location: Situated at the heart of Southeast Asia, Vietnam enjoys convenient access to major markets like China, Japan, South Korea, the US, and the EU. Furthermore, Vietnam benefits from preferential trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA). These agreements substantially reduce tariffs and expand Vietnamese product reach.

2. Embracing design complexity: Vietnam has ascended the value chain by shifting from basic and low-value items to sophisticated, high-value products such as outerwear, sportswear, and functional clothing. Investment in design and collaboration with international designers and brands has enabled Vietnam to establish its own fashion labels and make a mark in the industry.

3. Enhanced productivity and quality: Vietnam has made significant strides in boosting productivity and improving quality standards within the textile and apparel sector. By embracing advanced technology, automation, anddigitalization, Vietnam has achieved higher efficiency. Moreover, the industry’s adherence to stringent quality standards and compliance requirements has effectively catered to the demands of global buyers and consumers.

By capitalizing on these strengths, Vietnam’s textile and apparel industry is poised for continued success and growth.

Vision 2030: A Pathway to $100 Billion and Beyond

Vietnam’s textile and apparel industry has set an ambitious vision for 2030, aiming to achieve $100 billion in export value, capture 30% of the domestic market share, and maintain 50% local content. To realize this vision, the industry must overcome certain challenges while leveraging potential enablers, including:

1. Supply chain management and distribution: Vietnam needs to enhance supply chain efficiency and resilience, particularly in the context of the COVID-19 pandemic and trade tensions between the US and China. Diversifying export markets and developing domestic distribution channels, such as e-commerce and retail, are also crucial.

2. Sustainability: Adopting more sustainable practices and solutions is essential for Vietnam’s textile and apparel industry. This includes utilizing renewable energy, reducing water and chemical consumption, promoting recycling and reuse, and embracing the principles of a circular economy. Compliance with environmental standards and regulations of trading partners is also vital.

3. Capacity building: Enhancing human capital and innovation capacity is imperative for the industry’s growth. This entails training and upskilling workers, attracting and developing talent, fostering research and development, and encouraging creativity and entrepreneurship.

4. Backward linkage and raw material procurement: Strengthening backward linkage and reducing dependence on imported raw materials, such as cotton, yarn, and fabric, are key priorities. Vietnam should diversify its sources of raw materials and bolster domestic production capacity, particularly for high-quality and functional materials.

5. Global marketing: Improving global marketing and branding strategy is crucial for the industry’s success. This involves creating a distinctive and positive image of Vietnamese products, increasing awareness and recognition of Vietnamese brands, and active participation in international trade fairs and fashion shows.

6. Employee retention: Enhancing employee retention and satisfaction is essential for a thriving textile and apparel industry. This includes offering competitive wages and benefits, ensuring safe and healthy working conditions, providing career development opportunities, and upholding labor rights and social responsibility.

7. Digital transformation: Accelerating digital transformation is paramount for Vietnam’s textile and apparel industry. Embracing Industry 4.0 technologies, such as artificial intelligence, big data, cloud computing, and blockchain, can boost productivity, quality, and innovation. Leveraging digital platforms like social media, e-commerce, and online design tools is also crucial for reaching and engaging customers.

8. Gender equality: Addressing gender discrimination is a critical aspect of the textile and apparel industry’s development. Ensuring equal pay and opportunities, preventing sexual harassment and violence, and empowering women workers and leaders are essential steps towards a more inclusive industry.

By addressing these factors, Vietnam’s textile and apparel industry can chart a pathway towards achieving its ambitious goals and making a lasting impact in the global market.

Conclusion

Vietnam’s textile and apparel industry is a rising star in the global market, with impressive growth, competitive advantages, and ambitious vision. However, the industry in Vietnam also faces some challenges and opportunities, which require strategic actions and solutions. By overcoming the difficulties and leveraging the enablers, Vietnam’s textile and apparel industry can achieve its full potential and contribute more to the country’s economic and social development.

Click here, to read more about Vietnam’s Garment Industry and their Vision for 2030.

About the Author: In this dynamic and competitive market, Groyyo Consulting stands out as a visionary company that aims to standardize apparel manufacturing across Asia. Established in India in 2021, Groyyo is touted to become Asia’s largest manufacturing ecosystem, infusing tech-enabled Groyyo Future Smart standards for connected manufacturing with optimum manufacturing KPIs as per the local manufacturing condition.

Divya Mohan

Business Manager

Leave a Comment